Posts

Function W-8BEN-Age may also be used to point out that the fresh foreign organization are excused from Function 1099 reporting and you can duplicate withholding to have earnings that’s not at the mercy of part 3 withholding and that is perhaps not a great withholdable fee. For example, a foreign organization might provide a type W-8BEN-Elizabeth in order to a brokerage to ascertain your disgusting arises from the fresh selling of securities commonly at the mercy of Form 1099 revealing otherwise content withholding. A good QI could be a foreign mediator (or overseas branch out of an excellent U.S. intermediary) who may have joined to your a good QI contract (talked about later) on the Irs. Particular organizations may also play the role of QIs even if he’s not intermediaries.

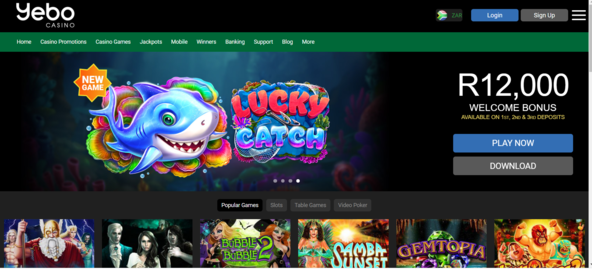

Find out more from the our issues & features: kitty glitter casino

- Its not necessary so you can withhold tax below chapter cuatro when the you will get an application W-8ECI on what a foreign payee helps make the representations discussed within the Withholding exemptions, earlier.

- Really sort of U.S. source money gotten from the a foreign person is at the mercy of U.S. tax of 31%.

- The brand new WP have to withhold less than part three or four to your day it will make a delivery from an excellent withholdable payment or an number subject to chapter step 3 withholding in order to an immediate foreign companion in accordance with the Setting W-8 otherwise W-9 they receives from the couples.

- Also remember these day there are a lot of alternatives with a great 5% put of lenders not using the brand new system, many of which can be used to get to £600,100000 on the apartments.

- Because of the getting off a deposit, you have demostrated debt stability and you may power to perform mortgage repayments.

Certain overseas firms that are NFFEs functioning on part out of persons aside kitty glitter casino from investors otherwise overseas central banking institutions from issue may apply at the new Internal revenue service to become QIs. Withholding overseas partnerships and you can withholding foreign trusts commonly flow-thanks to organizations. Basically provides a declare, how to establish that i own the items with already been taken or destroyed? Your own claim adjuster often request you to render facts and you may files one establish control of one’s private property. These may tend to be but they are not limited in order to invoices from buy, mastercard statements, owner’s manuals, pictures otherwise a video list of one’s own possessions. We prompt all of the policyholders to keep photos otherwise videos list of its private possessions at the an off-site venue.

The fresh nonresident alien personal may have to make you an application W-4 or a form 8233. Such versions is actually talked about inside the Buy Personal Features Performed less than Withholding to the Certain Earnings, afterwards. The word “part step 3 withholding” is utilized within book descriptively to mention in order to withholding necessary below sections 1441, 1442, and 1443. Usually, part step three withholding refers to the new withholding program that really needs withholding to the an installment out of U.S. source money. Payments in order to foreign people, as well as nonresident alien someone, foreign entities, and you may governments, may be at the mercy of part step three withholding.

Payee Paperwork From Intermediaries or Circulate-As a result of Organizations

A foreign entity is actually subject to part 4 withholding if this try a great nonparticipating FFI or an inactive NFFE that does not supply the appropriate degree from its ample You.S. owners. A good nonparticipating FFI is actually a keen FFI besides a good using FFI, deemed-compliant FFI, otherwise exempt useful manager. Repayments these types of communities, however, need to be claimed for the Form 1042-S if your fee try subject to section 3 withholding, even when no taxation are withheld.

NRI Membership Benefits You have to know

See point 897(c)(6)(C) more resources for the newest positive possession regulations. The fresh temper of an excellent USRPI by a different person (the brand new transferor) are subject to taxation withholding below area 1445. If you are the brand new transferee, you must see if the brand new transferor is actually a different people. If your transferor is a foreign people and also you fail to keep back, you happen to be stored responsible for the new income tax.

- Withholding is necessary whether the percentage is accumulated with respect to most other people or with respect to various other part of the same entity.

- More often than not, an officer away from a firm are a member of staff, however, a movie director acting within capacity is not.

- (2) Should your physician chosen by the citizen refuses to or do perhaps not satisfy criteria given within area, the brand new studio get find option doctor involvement while the specified inside paragraphs (d)(4) and (5) of the part to assure provision from compatible and you may enough care and attention and you may procedures.

- To own section cuatro objectives, when you’re and make a great withholdable payment to help you a good fiscally clear organization, you ought to implement the guidelines out of section 4 to choose the payee (applying the regulations discussed prior to) and you can if or not part 4 withholding relates to the fresh commission centered on the new payee’s chapter 4 reputation.

You could make so it designation just while in the a good 90-day period one starts for the date of the punishment observe. For deposits produced by EFTPS to be on go out, you need to start the fresh deposit by 8 p.yards. If you use a 3rd party to make dumps on your account, they could features various other cutoff times. The costs will likely be produced in U.S. bucks and should be made inside the U.S. dollars. The fresh specifications of your own Hungary and Russia treaties exempting tax to your gambling payouts in the united states are no lengthened running a business.

If your business does not have any revenues regarding step 3-12 months period, the fresh research period ‘s the income tax season the spot where the bonus try repaid. Quite often, the new home-based business find their energetic international business money from the consolidating the money and also the money of any subsidiary where it is the owner of, myself or indirectly, 50% or maybe more of the inventory. But not, if the assessment several months includes step 1 or maybe more tax decades delivery ahead of January step one, 2011, this provider may use merely its revenues for your taxation year birth ahead of January step one, 2011, and can meet the 80% test should your adjusted average part of active overseas team earnings is over 80%. But in the example of desire paid back to the an obligation out of the united states, attention paid so you can a lender to your an expansion of borrowing made pursuant to that loan agreement inserted to your regarding the normal path of your bank’s exchange or organization will not be considered because the profile interest.

Just how an intermediary can assist thinking-functioning someone

Make sure to look at your type of pact to your certain price you to definitely applies to you.. Reduced rate otherwise exception out of section step 3 withholding to have focus paid because of the foreign businesses (Money Password 4). Reduced speed otherwise exception of part step 3 withholding to have interest paid back to help you handling international firms (Income Password step 3). Documents is not needed to have desire for the bearer loans to qualify while the collection attention. In some cases, although not, you need documents to have purposes of Function 1099 reporting and you will copy withholding.

The quantity knew has the bucks paid back, the new reasonable market value away from possessions transmitted, and the assumption away from and you can rest from debts, and debts that the partnership desire is subject. Section of the TCJA added part 1446(f) active for transmits of connection hobbies occurring to the otherwise once January step 1, 2018. Area 1446(f) fundamentally necessitates that an excellent transferee away from an interest in a collaboration withhold 10% of your amount realized to the disposition or no part of the newest obtain, or no, will be treated under point 864(c)(8) while the effortlessly related to the new conduct out of a trade otherwise business inside the All of us. A move can occur whenever a collaboration delivery causes gain lower than point 731. Under area 1446(f)(4), if the transferee doesn’t keep back one needed count, the relationship need to subtract and keep back away from withdrawals for the transferee extent the transferee failed to keep back (in addition to focus).

Lenders may also determine your earnings-to-debt proportion to be sure the financing try reasonable and you may acquired’t filters your finances. If the claimants out of an NRE term put account out of a dead depositor are people, the newest put for the readiness will likely be managed since the a domestic rupee label deposit and you can attention might be covered the following several months at a consistent level relevant to a residential name put out of similar readiness. (c) In the event of busting of your quantity of name deposit in the the newest demand on the claimant/s from dead depositors otherwise Shared customers, zero penalty to have early withdrawal of your label put will be levied if the period and you will aggregate level of the fresh deposit do maybe not experience any alter. The new trusted and you can proper way for an income tax refund are to elizabeth-document and pick lead put, and therefore securely and electronically transmits their reimburse directly into debt account. Head put along with avoids the chance that the consider was forgotten, taken, destroyed, otherwise came back undeliverable to the Internal revenue service. For those who don’t has a bank checking account, visit Internal revenue service.gov/DirectDeposit more resources for how to locate a financial otherwise credit connection that can discover an account on the web.

All round regulations for making payments from taxation withheld lower than part 1446(a) don’t apply to PTP distributions. As an alternative, implement the principles mentioned before, below Placing Withheld Taxation. To make sure proper crediting of your withholding income tax when revealing to help you the newest Irs, the relationship need tend to be per lover’s U.S. If there are couples from the union rather than identity quantity, the relationship is to inform them of one’s would like to get a good count. Partners who’ve if not provided Setting W-8 so you can a collaboration to own purposes of area 1441 or 1442, while the mentioned before, can use an identical form to have reason for point 1446(a) once they meet the requirements mentioned before below Records.

A good WP is also remove as the direct lovers the individuals secondary partners of the WP by which they applies shared account treatment or the new service option (discussed later). A great WP need to if not issue an application 1042-S to every mate to the the total amount it is required to get it done beneath the WP arrangement. You could matter just one Mode 1042-S for everyone money you create to help you a WP other than repayments whereby the newest entity cannot play the role of a good WP. You may also, however, have Setting 1099 standards for sure indirect partners out of a great WP that are U.S. taxable recipients. To have purposes of chapter cuatro, an intermediary otherwise disperse-as a result of entity which is an excellent acting FFI or entered deemed-certified FFI getting a good withholdable commission will get, as opposed to getting paperwork for every payee, render pooled allowance information, while the explained below FFI withholding report, second. In the case of a great withholdable commission made to an organization, you ought to along with get the appropriate paperwork to determine one withholding doesn’t use below part 4.

Comentários